If the two totals do not agree, an error has been made, either in the journals or during the posting process. The error must be located and rectified, and the totals of the debit column and the credit column recalculated to check for agreement before any further processing can take place. A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly. Before you take on any small-business bookkeeping tasks, you must decide whether a single- or double-entry accounting system is a better fit. The entry system you choose impacts how you manage your finances and how your bookkeeping processes will work.

Bookkeeping Options for Small Business Owners

Remember that the basic goals of bookkeeping are to track your expenses and profits, and to ensure you collect all necessary information for tax filing. Business accounting software and modern technology make it easier than ever to balance the books. A platform like FreshBooks, specifically designed for small business owners, can be transformational. As a business owner, it is important to understand your company’s financial health. Bookkeeping puts all the information in so that you can extract the necessary information to make decisions about hiring, marketing and growth.

A lot goes into it—from managing payables and receivables to balancing books. But what might seem like an overwhelming task isn’t so bad when you accounting methods to determine salvage value break it down to the bookkeeping basics. With this type of service, you can communicate completely by email or phone without having to set aside time to meet in person.

If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging. On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done. Now that you have a better understanding of bookkeeping, you may be wondering if it’s something you want to take on yourself or with the help of a professional. There are several effective ways to manage bookkeeping responsibilities in-house or externally by using helpful tools and technologies. Bookkeeping beginners need quick wins to get started quickly and efficiently.

Handle accounts receivable and payable

Most individuals who balance their check-book each month are using such a system, and most personal-finance software follows this approach. If not done at the time of the transaction, the bookkeeper will create and send invoices for funds that need to be collected by the company. The bookkeeper enters relevant data such as date, price, quantity and sales tax (if applicable).

- At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates.

- Tracking your AR, usually with an aging report, can help you avoid issues with collecting payments.

- Column One contains the names of those accounts in the ledger which have a non-zero balance.

- The service you decide to use depends on the needs of your business and may include extra features such as payroll or tax documents.

- You’ll need to note the amount, the date, and any other important details to ensure you can accurately summarize your finances when it comes time for tax season.

While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional. It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials. Efficient bookkeeping involves foresight, meaning that a business should always plan for upcoming financial events, including tax time. Good preparation and documentation are critical for paying taxes (including payroll taxes) on time. The information you get from your receipts should go into some kind of ledger (usually a digital option). Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in versus what is going out.

Bookkeeping basics FAQ

If you go this route, make sure to brush up on interview questions that’ll help you determine who’s the reporting and analyzing current liabilities best fit. Let us walk you through everything you need to know about the basics of bookkeeping. Her work has been featured on US News and World Report, Business.com and Fit Small Business. She brings practical experience as a business owner and insurance agent to her role as a small business writer.

There are countless options out there for bookkeeping software that blends a good price with solid features and functionality. The specific answer to this question can vary somewhat depending on the balance sheet and income statement the extent of bookkeeping services your company needs, and how often you require the services of a small business bookkeeper. For full-time bookkeepers, the average annual salary sits around $77,000, according to Glassdoor. Bookkeeping is one of the most important tasks that a business owner will delegate over the life of a business.

Bookkeeping best practices for success

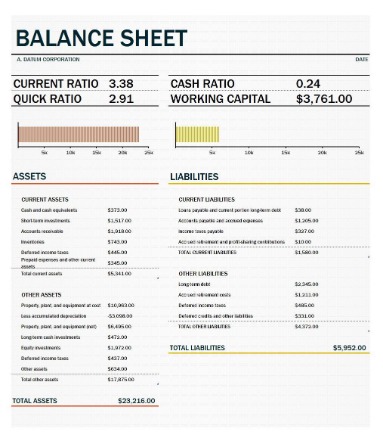

And since it takes equity, assets and liabilities — on top of expenses and income — into account, it typically gives you a more accurate financial snapshot of your business. There’s good news for business owners who want to simplify doing their books. Business owners who don’t want the burden of data entry can hire an online bookkeeping service.

Many accountants also prepare tax returns, independent audits and certified financial statements for lenders, potential buyers and investors. Accounting software can streamline your bookkeeping process and make your financial management more efficient. It’s useful for business owners looking to save time and avoid common accounting errors. Bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business.